She founded Business Accounting Basics, where she provides free advice and resources to small businesses. A higher debt-to-equity ratio means the company relies more on debt to finance its operations. This could signify you need millennials heres how to attract hire and keep them happy. financial trouble if the debt is not being paid back. The balance sheet is organised into distinct sections, each displaying the total of corresponding accounts along with their respective sub-accounts and balances.

What is Included in the Balance Sheet?

The total assets, liabilities, and equity should be similar to the parent company. While recording the consolidated balance sheet, it’s essential to modify the subsidiaries assets figures so that they indicate the accurate market value. Also, the parent company revenue should not be included in this sheet because the net change is ₹0. To make sure that the company has enough money to give refunds, a balance sheet reserve of ₹1,00,000 is created. As customers demand refunds, Company ABC reduces the ₹1,00,000 reserve. Especially insurance companies regularly create balance sheet reserves to make sure they have sufficient funds to pay out claims.

Balance Sheet Calculator — Excel Template

Companies that report on an annual basis will often use December 31st as their reporting date, though they can choose any date. Harvard Business School Online’s Business Insights Blog provides the career insights you need to achieve your goals and gain confidence in your business skills. When teams have clarity into the work getting done, there’s no telling how much more they can accomplish in the same amount of time. There are a few common components that investors are likely to come across.

Why You Can Trust Finance Strategists

- The working capital requirement shows the need to finance jobs once current liabilities have been used up.

- This financial statement lists everything a company owns and all of its debt.

- For instance, a building that was purchased in 1975 for $20,000 could be worth $1,000,000 today, but it will only be listed for $20,000.

- The Smartsheet platform makes it easy to plan, capture, manage, and report on work from anywhere, helping your team be more effective and get more done.

Dear auto-entrepreneurs, yes, you too have accounting obligations (albeit lighter ones!). From understanding the rates that apply, to choosing the scheme and making the declaration, we cover everything you need to navigate the world of VAT with peace of mind. It is a common practice to add some of the subsidised items like entrance fees, legacies and life membership fees precisely in the capital fund. Not only will you need to know this figure, but potential buyers will want to know—and have the proof to back it up.

Gain Insight into Your Company’s Financial Position with Balance Sheets in Smartsheet

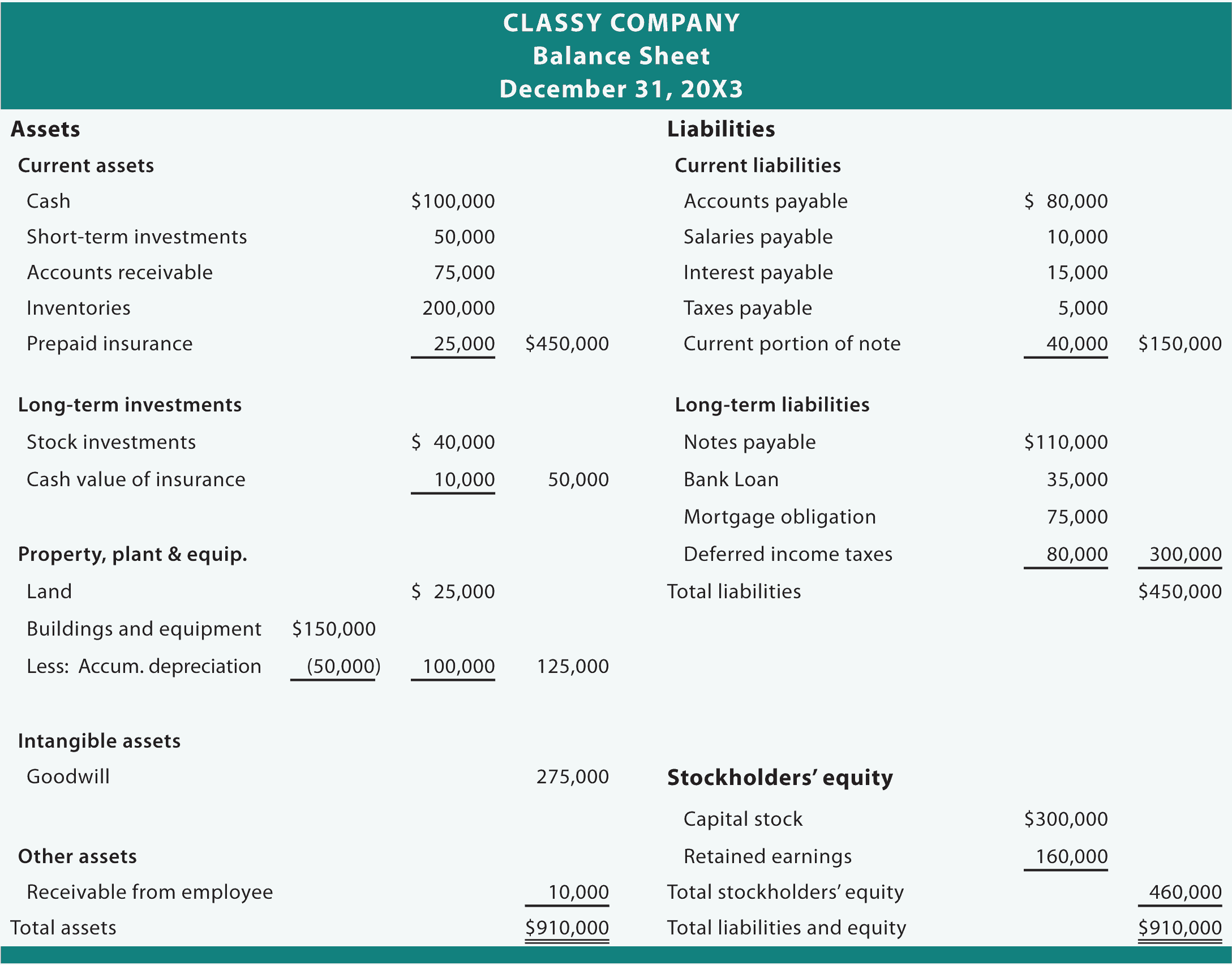

To do this, you’ll need to add liabilities and shareholders’ equity together. Depicting your total assets, liabilities, and net worth, this document offers a quick look into your financial health and can help inform lenders, investors, or stakeholders about your business. Based on its results, it can also provide you key insights to make important financial decisions. A company’s balance sheet is one of the most important financial statements it produces—typically on a quarterly or even monthly basis (depending on the frequency of reporting). The horizontal balance sheet presents assets on the left side of the page, and liabilities and equity on the right side. This is a useful presentation format when there are many line items, and you are trying to keep all of the information on a single page.

Current Assets

As you can see, it starts with current assets, then the noncurrent, and the total of both. Like assets, liabilities can be classified as either current or noncurrent liabilities. Noncurrent assets include tangible assets, such as land, buildings, machinery, and equipment. The revenues of the company in excess of its expenses will go into the shareholder equity account. If the company takes $10,000 from its investors, its assets and stockholders’ equity will also increase by that amount.

You will no longer have any doubts about the classification of shareholders’ equity, fixed assets, trade payables and stocks. The distinction between uses (assets) and resources (liabilities) will become clear. ‘Not-for-Profit’ Organisations design Balance Sheet for determining the financial position of the establishment.

Although balance sheets are important, they do have their limitations, and business owners must be aware of them. It is also helpful to pay attention to the footnotes in the balance sheets to check what accounting systems are being used and to look out for red flags. Additionally, a company must usually provide a balance sheet to private investors when planning to secure private equity funding.