These revenues will be balanced on the assets side, appearing as cash, investments, inventory, or other assets. Investors and potential stakeholders often use the balance sheet to assess a company’s financial health before making investment decisions. A strong balance sheet can attract investors and enhance your business’s reputation. And along with a profit and loss statement (also called an income statement) and a cash flow statement, a balance sheet is one of your business’s most essential financial documents. You’ll be drawing up a lot of balance sheets, and if you want your business to stay in the black, you need to know how balance sheets work, how you read them, and how you can create your own. This includes debts and other financial obligations that arise as an outcome of business transactions.

Can You Explain the Difference Between Assets and Liabilities on a Balance Sheet? – Questions About Balance Sheets

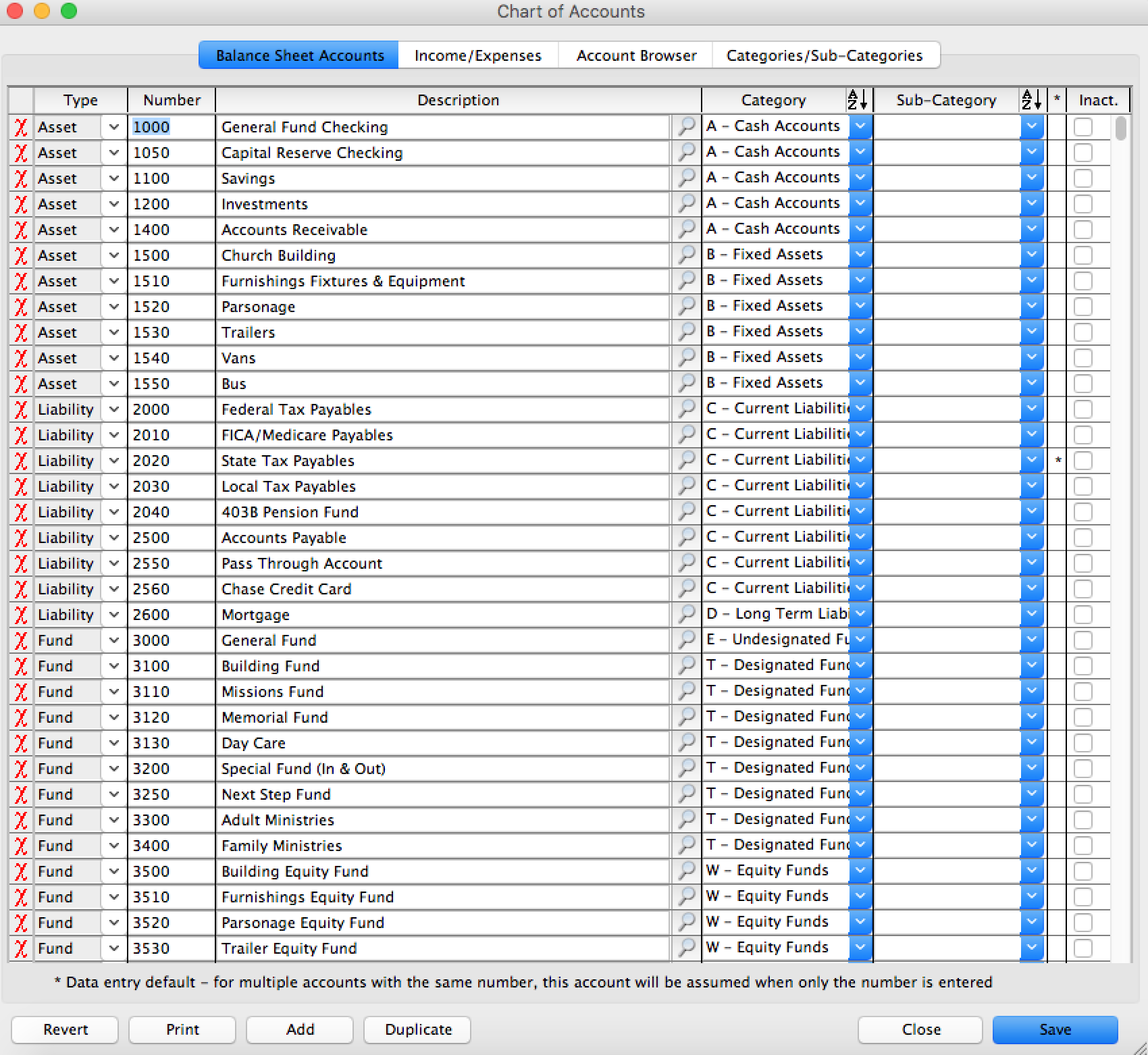

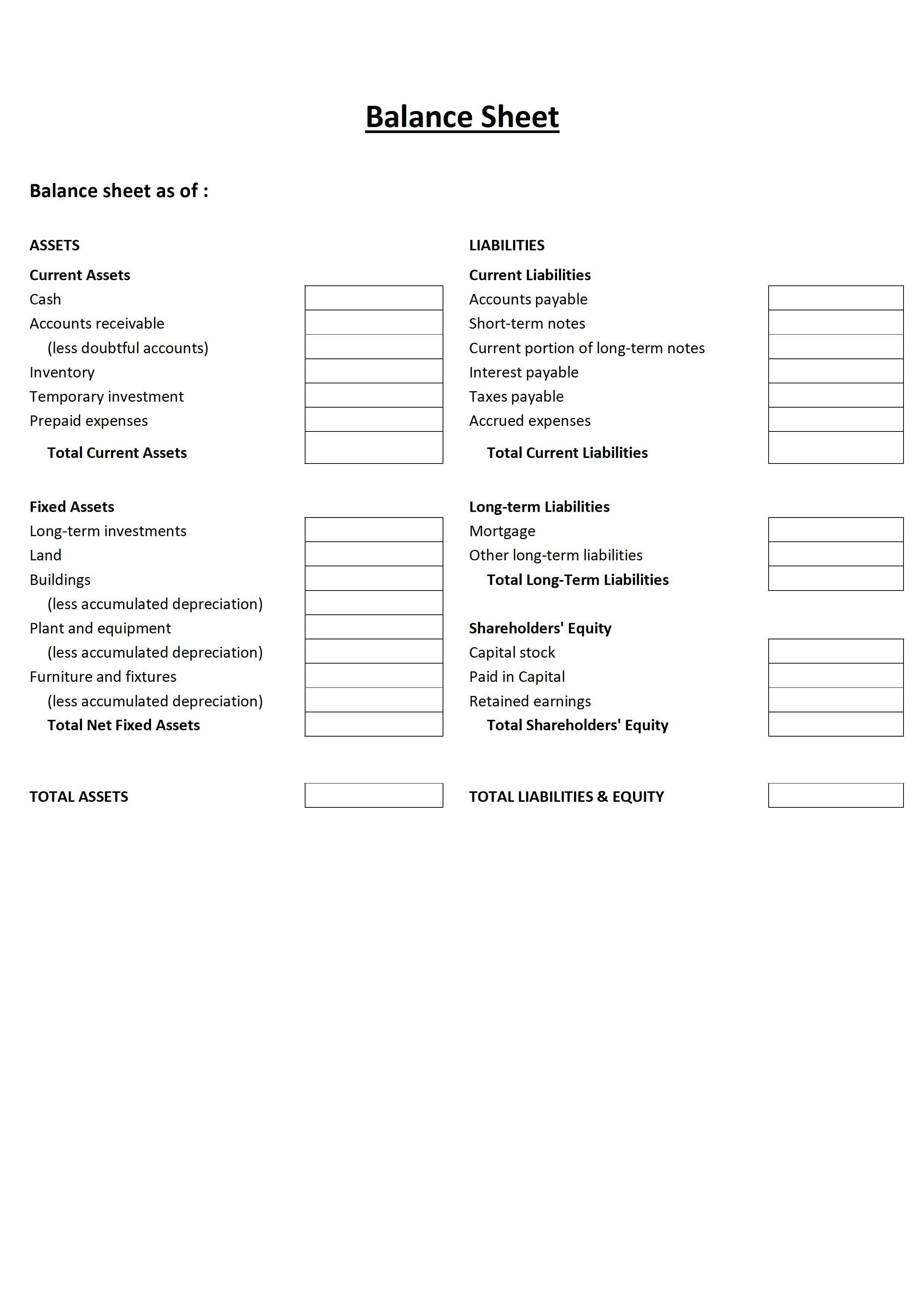

Long-term liabilities, on the other hand, are due at any point after one year. Apart from routine intervals, certain trigger events may necessitate an immediate balance sheet update. Examples include seeking funding, applying for loans, mergers and acquisitions, or significant changes in the business’s financial circumstances. But balance sheets are simple enough that can a capital loss carry over to the next year you can catch errors quickly, if not on the current sheet then on the next one you draw up. You can create your own two-column balance sheet using spreadsheet software or even download an easy Excel balance sheet template that helps you put one together. That’s obviously the easiest, most simplistic example; alas, creating your first balance sheet won’t be that easy.

Debt vs. Equity

It also plays a role in determining your creditworthiness to lenders and creditors, affecting borrowing terms and financing options. With this knowledge, you can make well-informed financial decisions that align with your business objectives, mitigate risks, and pave the way for sustained growth and success. By comparing balance sheets from different periods, you can identify trends and patterns in your business’s financial position. This trend analysis aids in making informed decisions and spotting potential areas for improvement. Shareholders’ equity represents the residual interest in the company’s assets after deducting liabilities. It includes common stock, preferred stock, retained earnings, and additional paid-in capital.

Net Worth (Shareholders’ Equity) = Total Assets – Total Liabilities

It is also known as net assets since it is equivalent to the total assets of a company minus its liabilities or the debt it owes to non-shareholders. That’s because a company has to pay for all the things it owns (assets) by either borrowing money (taking on liabilities) or taking it from investors (issuing shareholder equity). Financial statements record the various inflows and outflows of capital for a business.

- To help you, we’ll explain what goes on a balance sheet and how to leverage balance sheets for growth.

- First, the fixed asset turnover ratio (FAT) shows how much revenue a company’s total assets generate.

- All liabilities that are not current liabilities are considered long-term liabilities.

- Unlike the asset and liability sections, the equity section changes depending on the type of entity.

- When paired with cash flow statements and income statements, balance sheets can help provide a complete picture of your organization’s finances for a specific period.

The asset section is organized from current to non-current and broken down into two or three subcategories. This structure helps investors and creditors see what assets the company is investing in, being sold, and remain unchanged. Ratios like the current ratio are used to identify how leveraged a company is based on its current resources and current obligations. Also called the acid test ratio, the quick ratio describes how capable your business is of paying off all its short-term liabilities with cash and near-cash assets. In this case, you don’t include assets like real estate or other long-term investments.

Balance sheets provide the basis for computing rates of return for investors and evaluating a company’s capital structure. A balance sheet is the summary of a company’s liabilities, assets, and shareholders’ equity at a specific point in time. The three segments of the balance sheet help investors understand the amount invested into the company by shareholders, along with the company’s current assets and obligations. Firstly, assess your business’s short-term liquidity by examining the ratio of current assets to current liabilities.

Assets refer to anything a business owns that offers current or future value. The assets section on a balance sheet lists everything your company retains with value. Balance sheets organize assets by liquidity or how easily they convert to cash. Do you want to learn more about what’s behind the numbers on financial statements? Explore our finance and accounting courses to find out how you can develop an intuitive knowledge of financial principles and statements to unlock critical insights into performance and potential. Balance sheets are one of the most critical financial statements, offering a quick snapshot of the financial health of a company.

Companies settle their liabilities by paying them back in cash or providing an equivalent service to the other party. A company’s balance sheet is one of the most important financial statements it produces—typically on a quarterly or even monthly basis (depending on the frequency of reporting). US GAAP includes basic underlying accounting principles, assumptions, and detailed accounting standards of the Financial Accounting Standards Board (FASB). All assets that are not listed as current assets are grouped as non-current assets. A common characteristic of such assets is that they continue providing benefit for a long period of time – usually more than one year.

Asset accounts will be noted in descending order of maturity, while liabilities will be arranged in ascending order. Under shareholder’s equity, accounts are arranged in decreasing order of priority. An asset is something that the company owns and that is beneficial for the growth of the business. Assets can be classified based on convertibility, physical existence, and usage. After you’ve identified your reporting date and period, you’ll need to tally your assets as of that date.

It is crucial to remember that some ratios will require information from more than one financial statement, such as from the income statement and the balance sheet. Noncurrent or long-term liabilities are debts and other non-debt financial obligations that a company does not expect to repay within one year from the date of the balance sheet. Measuring a company’s net worth, a balance sheet shows what a company owns and how these assets are financed, either through debt or equity. A company’s long-term debt, combined with specified short-term debt and preferred and common stock equity, makes up its capital structure.

This asset section is broken into current assets and non-current assets, and each of these categories is broken into more specific accounts. A brief review of Apple’s assets shows that their cash on hand decreased, yet their non-current assets increased. You can optimize cash flow and reduce operating inefficiencies by keeping track of accounts receivable, accounts payable, and inventory levels.